Integrated P&L, Balance Sheet & Cash Flow Statement Planning and Reporting Software Solutions

Integrated Financial Planning

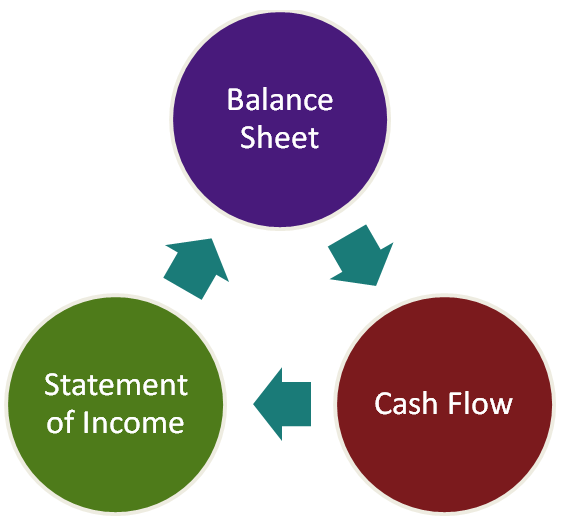

Integrated financial statements, plans and forecasts are key to ensuring the financial health of your organisation. But often this is a time-consuming, resource-intensive process. Typically it involves multiple spreadsheets with complex logic which lacks transparency. This leaves little time for running re-forecasts and scenarios.

Fluctuations in turnover, debtors, creditors, interest, investments, loans, covenants, taxes, currencies, etc all have complex effects on your liquidity. Corporate Planner Finance with its dynamic link between the P&L, balance sheet and cash flow statement transforms the speed and reliability of producing integrated financial statements, plans and forecasts. It brings transparency to the cause-and-effect relationships, ensuring that you always have a clear overview of how your organisation’s financial position and forecast cash flow. This enables you can make informed decisions for the future of your business.

.webp?width=1400&height=900&name=AA%20Software%20One%20(1).webp)

.webp?width=1400&height=900&name=AA%20Software%20Two%20(1).webp)

Benefits of Corporate Planner Finance

Agile integrated P&L, balance sheet and cash flow management with real-time forecasting and scenario planningAutomatic data transfer with drill down from all common finance, ERP systems and other source systems

Parallel use of internal reporting and multiple external accounting standards, such as local GAAP alongside IAS/IFRS

Makes handling of multiple companies, multiple currencies and inter-company transactions easy

Cuts greatly the time and effort to produce financial statements, plans and forecasts

Effortlessly incorporates your business logic (debtors, creditors, loans, covenants, taxes, currencies, etc) for forecasting and planning

Workflow, version control, and user roles & rights ensures process efficiency, tasks and reminders are scheduled, closely defined user access and data sharing, and the assurance of a ‘single version of the truth’

Platform independent web access with user based rights to reports and budgeting for ease of access and generation of ownership

The integrated financial plan must take into account many different factors:

- Sales – customers, seasonality

- Cost of sales and workforce size

- Stock levels

- Debtor and creditor payment profiles

- Capital changes

- Borrowings

- Tax

- Dividends

Added to this some finance teams will also need to plan including:

- Multiple Companies

- Multiple currencies

- Inter-company trading

Putting all these assumptions together drives the forecasted income statement, balance sheet and cash flow. Changing assumptions in any one area will directly impact the other two.

Safeguarding Liquidity

Solvency – and not profit alone – is what determines the continuity of a business. Knowing about the available funds is a matter of vital importance. With Corporate Planner Finance you can manage your entire business with an integrated, dynamic, approach. You can plan your liquidity requirements well in advance and take corrective action as and when necessary. The solution clearly shows you how the liquidity of your business is going to develop on the basis of all the operational budgets and scenarios that have been entered.

.webp?width=600&height=500&name=Safeguarding%20Liquidity%20(1).webp)

Financial planning with predefined planning logic

Corporate Planner Finance works with easily configured logic blocks that link P&L, balance sheet and cash flow. Using these logic blocks, you plan your P&L and your balance sheet, taking the business context into account as well as the interrelationships between the various sections of the plan.

When sales patterns change, or investments and loans need to be planned, or customer or supplier payment policies are altered, all these influencing factors interact and Corporate Planner Finance handles them seamlessly, transparently and robustly. KPI reports and banking covenants reports are produced. Intercompany reconciliation according to the leader-follower principle saves you valuable time and is also an excellent preliminary step for your consolidated financial statement.

Key Features of Corporate Planner Finance

Statutory Financial Consolidation Extension

By adding the Corporate Planner Consolidation option you extend the solution so that all the data from all the companies financial accounts, budgets, forecasts and scenarios are automatically directly integrated into Corporate Planner, audit standard certified, statutory financial consolidation application. The two applications Corporate Planner Finance and Corporate Planner Consolidation are fully integrated.

.webp?width=833&height=483&name=image3%20(2).webp)

Seamlessly Connected To Your System Environment

Our Corporate Planner solutions not only allow you to report, model and plan every financial aspect of your business, they can also connect to any of your pre-systems – ERP systems, software for financial and cost accounting, and the payroll processing software used in human resource management, for instance. These reliable connections enable automated data transfer and provide drill-down to transactions and vouchers.

Book a FREE Demo of Our Software

Our Corporate Planner solutions ease time and resource pressures while providing management with timely, accurate insights. With seamless integration to your existing systems, automated data transfers, and drill-down capabilities, you save time, reduce errors, and access the structured information needed for smarter decision-making.

Corporate Planner Finance Brochure

In any organisation, integrated P&L, balance sheet and cash flow reporting and planning is one of the most important administration tasks. Often this is time-consuming, resource-intensive, complex, and lacks transparency. Corporate Planner Finance changes all of this, ensuring that you always have a clear overview of how your organisation’s financial position and forecast cash flow, and enabling you to make informed decisions for the future of your business.

Fill in Your Details to Get Your FREE Guide

From Our Blog

Stay up to date with what is new in our industry, learn more about the upcoming products and events.

A Finance Leader’s Guide to Modern Planning and Forecasting in HE

5 Ways To Make Informed Financial Decisions With Corporate Planner