Budgeting and Reporting Software for Financial Services

Financial Service companies exist in a continually evolving and shifting environment, where effective planning, reporting and risk management is the key to success. Corporate Planner is the software solution that adapts flexibly to the needs of your business and grows with it all the time.

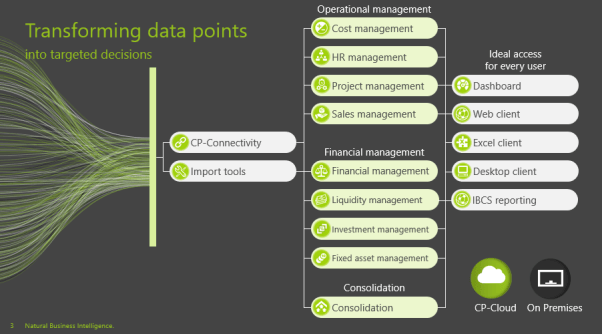

Corporate Planner offers complete data integration, it enables all data to be stored, analysed, forecast and reported on from one platform thus creating the centre for potential risk identification. Any shift in assumptions/reality will immediately flow through to the outputs and reports. Corporate Planner streamlines the processes enabling increased efficiency so you can act fast.

Corporate Planner provides a single source of the truth.

- Produce your monthly management report pack rapidly.

- Integrations with finance systems allow for drill down to transactional data.

- Streamline your budgeting process, with clear planning rules.

- Model debtor, stocks, creditor and capital plans.

- Create 1 year and multi-year forecasts in the same financial model.

- Monitor cash flow and banking covenant assumptions.

- Run scenarios to be prepared for both best and worst case forecasts

Integrated Financial Planning

Fluctuations in income, expenditure and planned investments and loans will all have complex effects on your liquidity. Corporate Planner Finance ensures transparency and brings stability to your financial plan. The dynamic link between the P&L, Balance Sheet and Cash Flow statement sheds light on cause-and-effect relationships. You always have a clear overview of how your company's cash balance is developing, so you can make sound decisions for the future of your business.

Advantages:

- Agile liquidity management with rapid forecasting and scenario planning

- Automatic data transfer from all common source systems

- Parallel use of accounting standards, such as UK GAAP alongside IFRS

- Business logic for all planning specifications

- A workflow guides the user step by step through the financial planning process

Safeguarding liquidity

Solvency – and not profit alone – determines the continuity of a business. Knowing about the available funds is of vital importance. With Corporate Planner Finance you can manage your entire business with an integrated approach. You can plan your liquidity requirements well in advance and take corrective action as and when necessary. The solution clearly shows you how the liquidity of your business is going to develop based on all the operational budgets that have been entered.

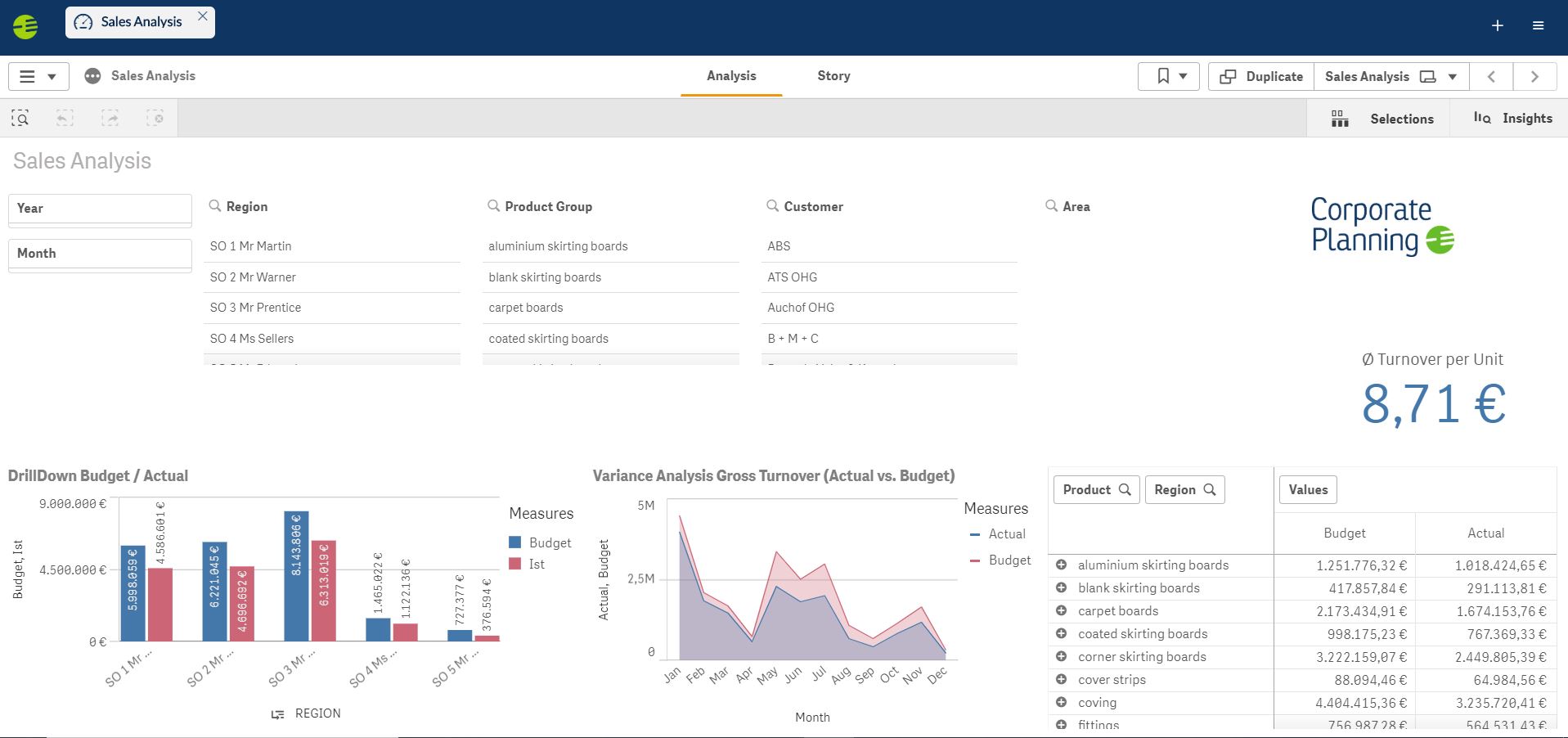

Customised reports for every decision-maker

With the help of a variety of report templates, you can set up a reporting system that is geared to its users. Each line manager, head of department or chief executive receives the information intended for them exactly when they need it. The report templates need only be defined once and are then always ready to use. Reports are available any time via self service web reporting. The reports are ready as soon as new data is loaded, enabling a rapid reporting cycle.

Financial Product Planning

Corporate Planner can be used to model different, financial service product revenue streams. Resulting in a dynamic cashflow, based on actual and forecast monetary flows which updates immediately following any input changes. Easy to read results enable diversification of both timing and sources of cashflow. Model key factors, such as:

- Number and value of policies / investments.

- Expenditure: Claims and capital or income costs.

- Income: Earned premium, commissions and interest received.

Overhead Management

Plan and report overheads by department. Simple web templates ensure users can quickly update budget and forecast data. No more crafting, sending and collating budget templates, budgets are aggregated automatically as soon as submitted. Clear reporting and self-service analysis can ensure budget holders have all information readily available.

Corporate Planner can be used to allocate overheads. Use various drivers, such as revenue, policies etc to allocate costs. Overheads apportioned for all scenarios, update forecast assumptions and instantly see net profit by revenue channel.

.webp?width=800&height=800&name=Overhead%20Management%20(1).webp)

The bridge to Financial Consolidation

For Company Groups, it is important to produce accurate consolidated financial statements on a quarterly or monthly basis to view current group performance. Both, Corporate Planner Finance and Corporate Planner Consolidation solutions, are fully integrated, so all the data from financial planning are automatically generated ready for use in the consolidated financial statement, producing a clear view of your group Companies and all their subsidiaries. This works for both actual and forecast data.

Book a FREE Demo of Our Software

If you're looking for a budgeting, planning, forecasting, and reporting process book your demo with us today!

5 Ways to Reduce Time on Budgeting and Forecasting

Are you looking for ways to make better decisions for your business? If the answer is yes, we have just the resource for you! Our guide is designed to show you how you can save time on budgeting and forecasting in your business.

Fill in Your Details to Get Your FREE Guide

From Our Blog

Stay up to date with what is new in our industry, learn more about the upcoming products and events.

Navigating Key Financial Challenges in UK Higher Education

Mastering Cash Management: How To Strengthen Liquidity and Financial Stability In Your Business